Investment Fundamentals for Real People

We've spent years watching everyday Canadians make avoidable financial mistakes. Not because they're careless—just because nobody explained this stuff in plain language. Our program changes that with practical sessions starting September 2025.

Teaching Methods That Actually Work

Most investment courses either oversimplify until they're useless, or drown you in jargon. We aim for something in between—detailed enough to be genuinely helpful, but explained like you're talking with someone who actually wants you to understand.

Each session builds on what came before. We start with core concepts in week one and add complexity gradually. By month three, you're analyzing real portfolios and understanding why certain strategies make sense for different life stages.

- Small group discussions where questions don't feel awkward

- Case studies pulled from actual client scenarios we've encountered

- Practice exercises using Canadian tax structures and market conditions

- Access to follow-up sessions when concepts need clarification

What You'll Learn Over Six Months

The program runs from September 2025 through February 2026. We meet twice monthly, with optional homework between sessions for those who want to dig deeper.

Weeks 1-4

Foundation Concepts

Risk tolerance, asset allocation basics, understanding returns beyond the headline numbers. We cover what those investment terms actually mean in practice.

Weeks 5-8

Canadian Market Mechanics

How TSX differs from US exchanges, currency considerations, why Canadian portfolios need different thinking than American ones.

Weeks 9-12

Tax-Efficient Strategies

RRSP versus TFSA decisions, dividend taxation, capital gains timing. The stuff that saves you real money when done right.

Weeks 13-16

Portfolio Construction

Building diversified holdings that match your timeline, balancing growth with stability, when to rebalance and when to leave things alone.

Weeks 17-20

Common Mistakes

We walk through actual examples of where people go wrong—emotional decisions during downturns, chasing returns, ignoring fees that add up.

Weeks 21-24

Long-Term Planning

Adjusting strategy as life changes, retirement income planning, estate considerations. How the approach shifts as you age.

Flexible Learning Format

Sessions happen Tuesday evenings (7-9 PM Atlantic) and Saturday mornings (10 AM-12 PM Atlantic). Pick whichever schedule works better—content is identical for both tracks.

Can't make a session? Recordings stay available for a year. Though honestly, the in-person discussion is where a lot of the learning happens, so try to attend live when possible.

Between meetings, you'll have optional reading and practice scenarios. These aren't graded or anything—they're there if you want extra practice with the concepts.

Who's Teaching This

We rotate instructors based on topic expertise. Everyone teaching has worked directly with clients, so they know where confusion typically happens and how to explain things more clearly.

Bjarke Lundqvist

Portfolio Strategy

Spent fifteen years helping mid-career professionals restructure investments. Good at explaining why certain allocations make sense for different life stages.

Vesna Aaltonen

Tax Optimization

Former CRA analyst who now helps people understand Canadian tax implications. She actually enjoys reading Finance Department bulletins, which is weird but helpful.

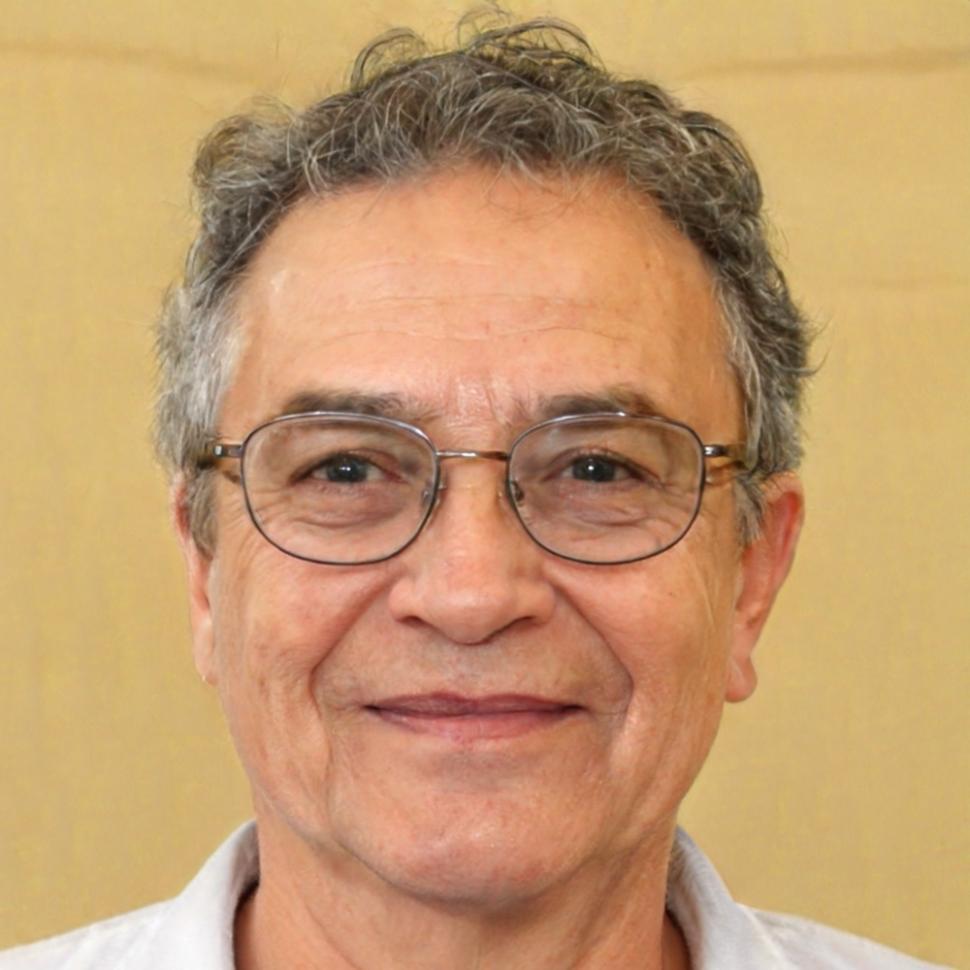

Callum Fitzroy

Market Analysis

Tracks Canadian equity markets and sector trends. Teaches the foundation modules and market mechanics sections with lots of current examples.

Dagmar Kovačević

Retirement Planning

Works primarily with clients approaching retirement. Handles the long-term planning modules and income strategy discussions.

Program Investment

Registration opens June 2025. Classes start first week of September. Space limited to 20 participants per track to keep discussions manageable.

Standard Enrollment

CAD $1,850

Full six-month program

- 24 live instructional sessions

- Recording access for one year

- Course materials and practice scenarios

- Email support between sessions

- Group discussion forums

With Advisory Access

CAD $2,650

Program plus consultation time

- Everything in standard enrollment

- Three one-hour advisory sessions

- Portfolio review and feedback

- Personalized strategy discussion

- Priority registration for future programs